Grinnell College finances more than half of its operations with funds drawn from its $2 billion endowment. That money supports financial aid to students, funds the construction of new buildings like the HSSC and pays the salaries of faculty and staff members. Drawing more from the endowment means that future generations of Grinnell students will have fewer financial resources for their education. And as the COVID-19 pandemic has ravaged the global economy, revenue at the College has dropped and costs have increased.

The strain has already taken its toll on many small liberal arts institutions across the Midwest. In May, for example, MacMurray College in Jacksonville, Ill. announced it would permanently close, unable to recover from the financial burden of the pandemic. Many other institutions are facing similarly bleak futures with no end in sight for long-standing financial woes. Grinnell has in many ways been the exception among small rural colleges, but COVID-19 has made its mark on the financial ledgers nonetheless.

This semester, The S&B dug into the College’s finances to determine how much the College has lost in revenue and how much they’re still spending on unexpected expenses such as personal protection equipment and COVID-19 tests. Here’s what we found.

Revenue has dropped dramatically

The most straightforward reduction to College revenue was the decision on April 16 to provide all Grinnell students with a $2,500 grant for the 2020-21 school year. This grant, according to Vice President for Enrollment Joe Bagnoli, was given to every student regardless of need, and directly reduced all students’ bills by $2,500. Applied to all of Grinnell’s nearly 1,500 students, this would mean about $3,680,000 will not enter College coffers this year.

In an email to The S&B, Bagnoli confirmed that the College estimates a revenue reduction between $3.3 million and $3.7 million because of the grant.

The College also announced on Nov. 17, 2020, that it would no longer include loans in student aid packages, giving students scholarships instead. That decision, according to the College’s press release, is expected to decrease revenue by an additional $5 million each year, but it will not go into effect until the fall 2021 semester.

There are also fewer students studying at Grinnell overall this year; only 1,472 enrolled for the Fall 2 term, compared to 1,645 in an average semester, according to Bagnoli. “The number enrolled fluctuates from fall to spring,” he said. “This year, a higher percentage of those students have chosen to take a leave of absence.”

In addition to a decrease in total numbers, almost all students attending classes are now living off campus — in the town of Grinnell or elsewhere — and therefore not paying for room and board at the College.

In normal times, room and board fees make up a substantial revenue stream. During the 2018-19 school year, according to Grinnell’s audited financial statements, the College collected nearly $19 million for room and board. For the fall semester of 2020 alone, following two annual increases in the comprehensive fees, each student would have paid $6,932 for room and board together, and the College could have expected to collect almost $12 million for room and board.

This semester, though, there are only about 130 students living on campus, said Dennis Perkins Jr., director of residence life. That means the College is likely to collect less than $1 million in room and board.

Combining lost revenue of about $11 million on room and board with the nearly $4 million in COVID-19 response grants means the College will not receive at least $15 million dollars in revenue from students. Other changes to student aid packages as family incomes decrease because of the pandemic will likely increase this number further. In an email to The S&B, Keith Archer, treasurer of the College, wrote that the institution forecasts about $18 million less net student revenue this year than in a typical year.

Net costs have increased

While revenue is down almost across the board, the cost picture is more complicated. Large numbers of student employees who usually work in the College’s physical facilities, like the dining hall, the mail room and the library, are not working this semester, thereby reducing College monetary outflows to students.

According to Archer, though, some of this amount has been offset by finding students new remote jobs and by changes to financial aid.

“The College has made every effort to provide employment opportunities for students, whether on-campus or attending remotely,” he wrote. “Even with that effort, it is true that there will still be less spent on student wages. However, we have worked hard to continue to support our students, including providing grant aid to offset the lost wages and the Covid-19 grant.”

According to Student Employment Coordinator Mark Watts, there were a total of 375 student workers employed by the College in Fall 2 this year, as opposed to 1081 student employees in fall 2019.

Ensuring that lost on-campus student jobs be replaced by new ones has been a primary focus of the Union of Grinnell Student Dining Workers (UGSDW), but the College has not taken radical measures like those suggested by the Union to help students whose jobs have been eliminated by the switch to remote learning.

In an Aug. 22 Q&A with The S&B, then UGSDW president Jacob Schneyer ’21 said, “There are lots of opportunities for previously existing jobs to be turned virtual and new ways for students to be supported virtually.”

The College is also spending more to overcome the challenges posed by the pandemic. To support students learning remotely, the College has sent Wi-Fi hotspots to students with trouble connecting to the internet and upgraded some professors’ tech equipment. The College also pays for licenses to use Microsoft Teams, Webex and Blackboard Collaborate. While large enterprises like Grinnell typically negotiate special rates for these services, a standard license for Webex costs about $107 per user for a semester; Blackboard markets Collaborate at $9,000 per department per year.

ITS head Dave Robinson did not respond to multiple requests for comment on College spending on technology.

Beyond remote learning technology, the College is also spending money to fight COVID-19 on campus. These costs include PPE and COVID-19 testing, as well as more intensive cleaning – costs which will only rise when about 300 first year students arrive on campus in January.

“We have our FM staff pretty much going through the floors and cleaning daily, sometimes two or three times a day, deep cleaning,” said Perkins. “So that’s costing actually more money than in a normal year.”

The costs of extra cleaning have been at least partially offset by minor decreases in spending on utilities. “While utilities spending is down slightly due to fewer students, faculty and staff on campus,” wrote Archer, “we remain committed to maintaining our buildings and grounds, so continue to invest in these areas.”

All pandemic-related expenses for the 2020-21 academic year, including new technology and infection-control measures, are expected to cost about $5 million, according to Archer.

The endowment has benefitted from strong stock markets

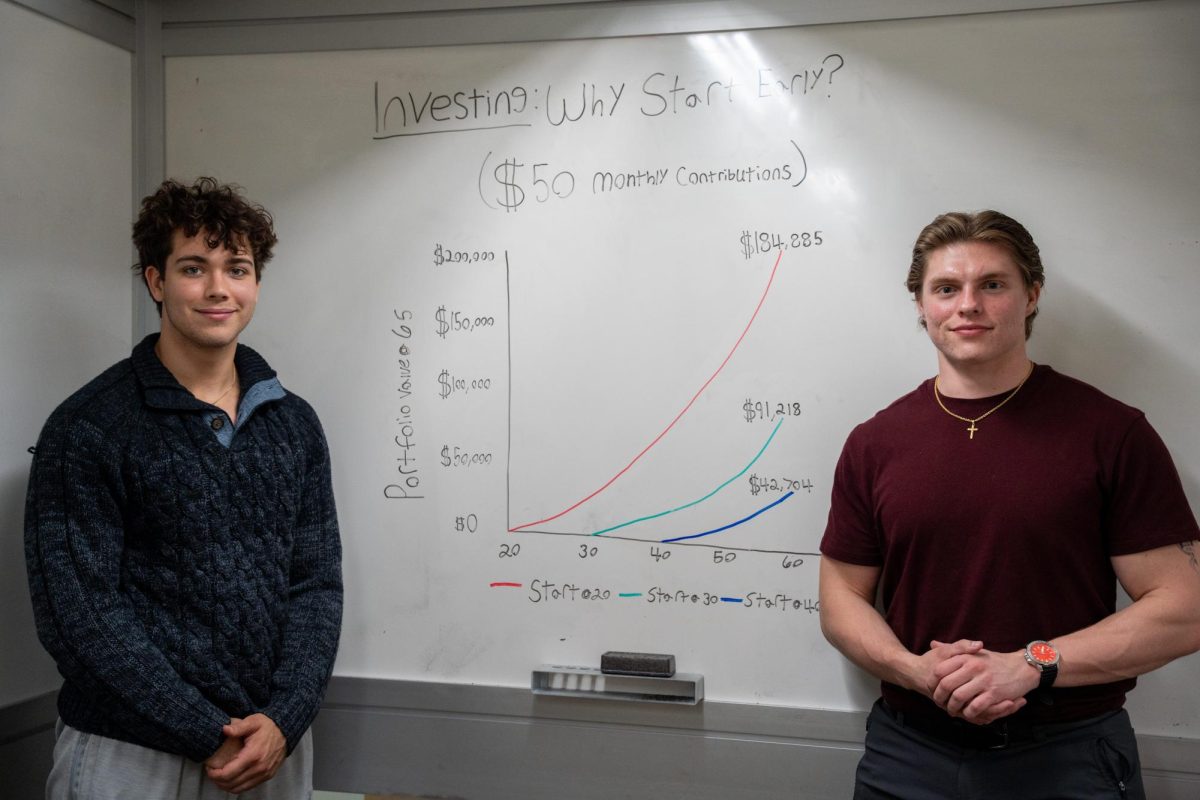

Rising costs and sinking revenues mean that the College will have to take more from its investment portfolio. At the end of June 2019, Grinnell’s endowment stood at $2.16 billion according to financial statements. Of that amount, about $1.7 billion was in equity interests, including publicly traded investments and private equity.

Since that time, the S&P 500 index, which tracks the performance of 500 of the largest publicly traded companies in the United States, rose by about 23 percent in aggregate, despite a sharp dip in the spring. Most stock indices are now well above their pre-pandemic levels, suggesting that the endowment has been relatively untouched by COVID-19. If Grinnell’s equity investments have grown at a similar rate to those listed on the S&P 500, then the College has gained about $400 million in endowment assets despite the press of the pandemic.

Chief Investment Officer Jainen Thayer did not respond to requests for comment, but Grinnell President Anne Harris noted strong endowment performance as among the reasons for the decision to eliminate loans from financial aid packages.

Despite the good performance of stock markets overall, some sectors have done much more poorly. In 2018, a Board of Trustees task force whose creation was spurred on by student activism put a spotlight on Grinnell’s fossil fuel holdings. In April 2018, that task force recommended, and the Board of Trustees directed, that Grinnell not divest from fossil fuels.

The College has not released information about how its fossil fuel investments, most of which are controlled by external fund managers hired by the College, have changed since that time. But investors have shunned oil and coal stocks during the COVID-19 pandemic, so if the College still holds coal and oil assets, their value has likely plummeted.

On June 30, 2017, according to the taskforce report, Grinnell held about $46 million in fossil fuel assets. Since then, fossil fuel companies listed on the S&P 500 index have decreased in value by a value-weighted average of 41 percent. Non-fossil fuel stocks, on the other hand, have grown by about 58 percent. Had the College transferred its $46 million investments in fossil fuel funds into other assets, it would have earned about $26.6 million; if Grinnell’s investment in fossil fuels has remained relatively constant, the College has lost about $19 million.

The College’s Investment Office did not respond to requests for comment about these estimates.

Percent change in total market capitalization of S&P 500 companies by category

Still, the stock market’s performance is overall good news for the College. In total, the College expects to take in about $18 million less from students than it would have in a normal year, even before accounting for the upcoming $5 million annual revenue decrease from removing loans from financial aid packages. Additionally, the College will spend at least $5 million this year on remote learning technology and infection control measures.

That means the College’s budget will take a $23 million hit — about 16 percent of the total budget. But ultimately, strong endowment growth will offset substantial decreases in revenue and increases in costs brought on by COVID-19.