The return of large numbers of students to Grinnell College’s campus, recent warmer weather and a fast pace of vaccination have all given a lifeline to Grinnell businesses that were struggling amidst the pandemic just a few months ago.

In normal years, Grinnell College students make up about 15 percent of Grinnell’s population, making the population indispensable to local businesses of all kinds. With about half of those students back in Grinnell for Spring Term 2, local businesses are seeing the increase in customers.

“We are so thankful to see the increase in Grinnell College students at our business again with the increase in students on campus,” wrote Dari Barn owner Ginette McFarland in an email to The S&B.

The long-time summer favorite had to eliminate walk-up service last year, instead only serving carry-out orders made by phone to avoid face-to-face contact. Customers kept ordering cyclones, though, some on Chow Now, an online food-ordering platform in which Dari Barn started participating last year. McFarland didn’t have to lay off any employees during the pandemic. Now, those employees are back to serving up fries and sundaes.

The pickup in student traffic hasn’t been universal, though. College students have always been an important part of business for The Music Shop, an instrument and electronics store on Broad Street, according to owner Dave Elliott. “We really missed the College, and we’re still missing them. [Students] really aren’t coming in yet. I get a stray one now and then, but not much,” said Elliott.

Businesses have also relied on government programs to stay afloat. Dari Barn was helped by a $49,380 loan last May as part of the federal Paycheck Protection Program (PPP), according to Small Business Administration data. That loan was paid back in full this January.

Lori Vos, owner of Village Decorating Studio and Loralei’s Giftshoppe, also received $21,111 in PPP funds. That loan, which has been forgiven by the federal government, was used to pay her three employees, she said.

Other Grinnell businesses were not so lucky securing federal loans. Eric Rees, owner of Ultimate Sports & Graphics, said his bank told him he wasn’t eligible for a PPP loan.

“I believe that somebody could have stepped up for sole proprietor, single-ran businesses and done something to contribute to them,” he said. “I tried to go to the bank, … [and] when we did that, being a sole proprietor, … I was ineligible; with no employees I didn’t make enough myself to gain from it and get any money out of it.”

Elliott, who is the sole proprietor of The Music Shop, said he collected state unemployment funds instead of any PPP money. That helped him weather a five-week closure of his store last spring.

A total of 408 PPP loans smaller than $150,000 were made to 383 Grinnell businesses over the last year, averaging $20,773. There were also 28 loans above $150,000, averaging $486,000. Some businesses received money from more than one of the three rounds of PPP funding authorized by congress. Loan amounts in Grinnell ranged from just over $500 to more than $5,000,000; in all, the federal government has forgiven a total of $16.6 million in loans to Grinnell businesses.

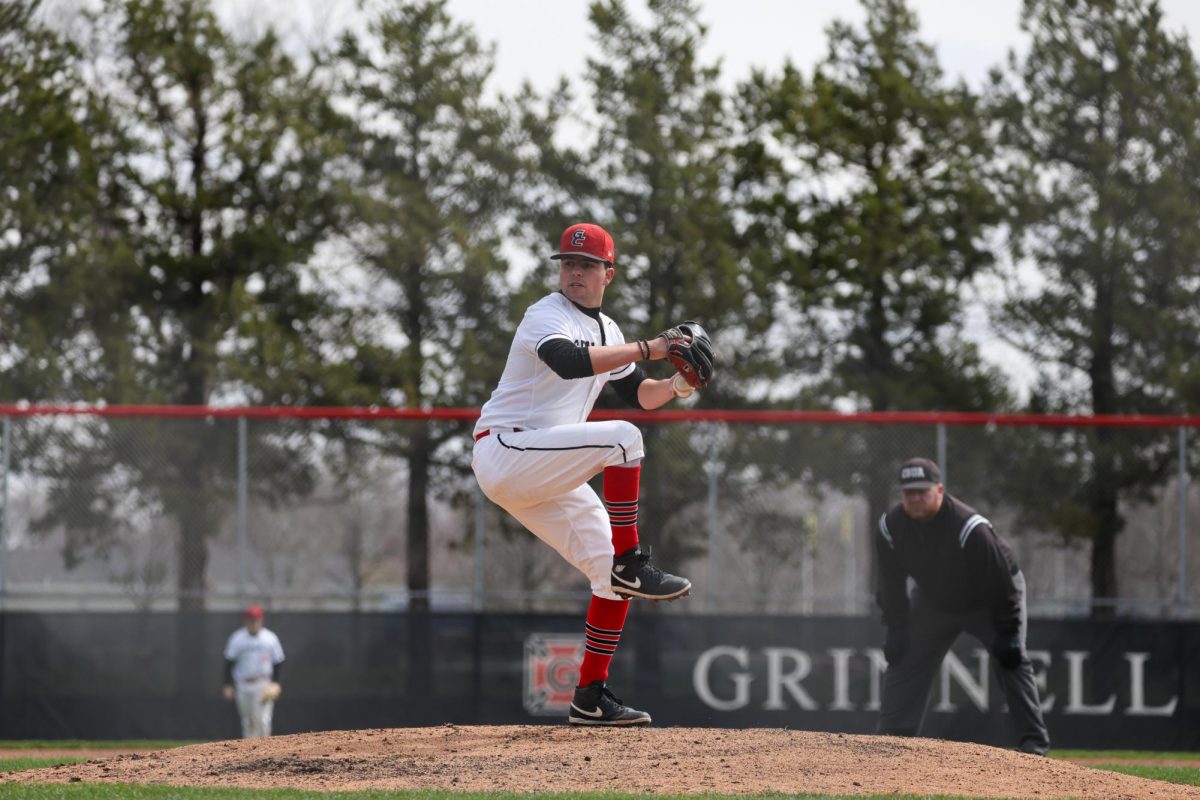

Even though he did not receive any PPP money, Rees’ business has survived the pandemic without catastrophic damage. During the fall, he said, sales were down approximately 15 to 20 percent, but have now mostly returned to normal levels. College business isn’t a big part of Rees’ revenue, he said, though the pickup in other sports has made a difference.

“As far as getting back everything that we lost due to COVID, I think we’re there,” Rees said.

“We got our little league back, high school sports are back, college sports just got their ok, we’ve had golf [and] baseball, … so we’ve gained back everything that we lost at this point.”

The Music Shop, though, is still feeling the squeeze of the pandemic. “Things have picked up a little bit, emphasis on a little bit,” said Elliott. The problems have been compounded by delays in getting products, like electric guitars and guitar strings, from China. Those factors have combined to make this year the worst in his 43 years of business in Grinnell, Elliott said.

Dari Barn’s costs have increased as well. “So much more of our food and ice cream is to-go and the cost of things like paper bags, lids, etc. have increased,” wrote McFarland. Though she did not provide specifics, PPE costs are also high, McFarland wrote, especially for nitrile gloves.

The costs of the pandemic aren’t merely financial for businesses and their employees.

“The hardest part of last year was trying to keep all our employees safe,” wrote McFarland. Dari Barn employees wear face masks to keep them safe at work, and customers don’t enter the building where ice cream is prepared.

Rees also wears a mask while at work but doesn’t require that customers do so. Neither do Vos and Elliott, though both said they themselves always wear a mask.

Both Rees and McFarland are hopeful for the future, as vaccinations and warmer weather draw more customers out of their homes.

“We have missed seeing everyone walking down the road for their food and ice cream,” wrote McFarland. “We hope that everything continues to head towards a new normal!”