With large numbers of Grinnell College students not returning to campus until at least February, local businesses are feeling the pinch.

During normal years, College students make up about 17 percent of Grinnell’s population, so even with some students remaining on-campus and more living in Grinnell, sales are down at many small stores and restaurants.

At Ultimate Sports and Graphics, which sells sports apparel, does screen printing and makes signs, business is 15 and 20 percent lower than in a normal year, according to owner and sole employee Eric Rees.

“We would still need things to turn around to even try to get back to somewhat normal again,” said Rees. “We would still survive [another 6 months] and make it work — I don’t see my business closing or anything due to it — but … we probably would have to go target more corporate and business [customers] for our apparel.”

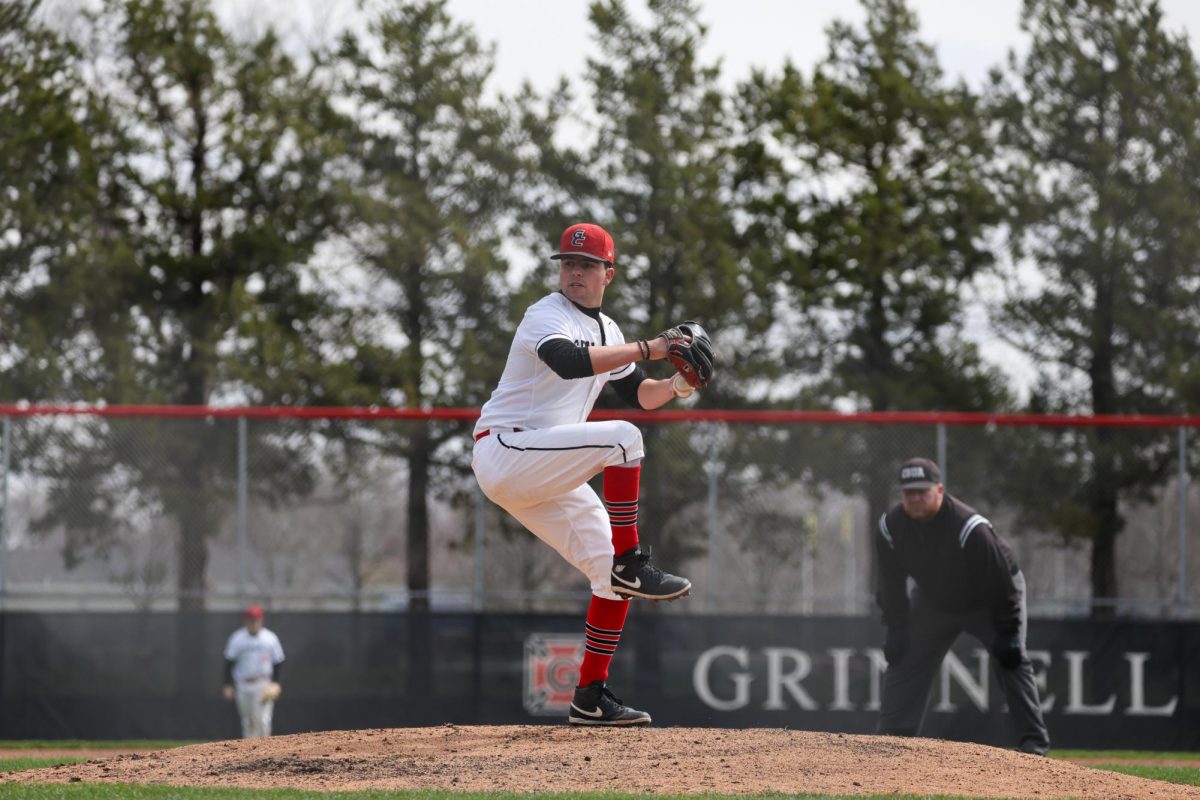

The loss of sales to the College’s sports teams, in particular baseball, basketball and football, has put a substantial dent in Rees’ business.

Dustin Sharp, an independent barber working at RJ’s Barber Shop, has also seen a decline in business, although he believes his business is less reliant on the student body than others. Sharp estimates that between 25 and 30 percent of his typical clientele is College-related.

“Fiscally, we can still bring in … the same money in a day’s time, but we’re just not booked out as far,” Sharp said. “There are days when we have [empty] appointments, which is abnormal. Before COVID, man, you had at least two or three days before you could get an appointment.”

Around the world, food service establishments have been particularly hard hit by the pandemic. Despite the challenges, Grinnell’s Prairie Canary is pushing ahead with its reopening.

“[Business] started off very, very slow when we got to open back up,” said Alex Philips, a manager at Prairie Canary. “It has been slowly ramping back up, but nothing compared to what business used to be like, especially with the non-return of many students.”

The College’s graduation and alumni weekends are some of the restaurant’s busiest times of the year, according to Philips. In 2020, both of those events were canceled.

Similarly, business from prospective students and visiting families has also been down compared to previous years, although Philips noted that he has seen a handful of prospective students in town.

Prairie Canary was closed from mid-March until the end of May, and during that time survived on carryout and delivery. “That is one thing that has changed in our whole business, is that carryout has become a lot more significant than it used to be,” said Philips.

Carryout sales were more than half of all business at the end of May, when the restaurant first reopened, according to Philips, but have steadily declined in importance since.

Businesses around Grinnell have also been adapting to the COVID economy by asking the government for financial support. According to Small Business Administration (SBA) data, 223 businesses in Grinnell have received money from federally backed Paycheck Protection Program (PPP) loans, ranging from $1,200 to more than $5 million. The SBA has not released the names of businesses which received loans smaller than $150,000, but 202 such loans were made in Grinnell. The average amount for a PPP loan under the $150,000 threshold was $24,482.

The program, funded by the federal CARES Act signed into law on March 27, provided government-backed loans to businesses with fewer than 500 employees, including some sole proprietors, according to the SBA. If employers kept employees on the payroll and use at least 75 percent of funds to pay wages, then the entire loan will be forgiven.

Since the start of the pandemic, according to the SBA data, 10 restaurants in Grinnell have gotten PPP money totaling around $390,000. Furthermore, 11 non-profits also received loans, totaling about $323,000. In all, businesses reported to the SBA that 813 jobs were retained in Grinnell because of the PPP.

Sharp is self-employed and pays rent to operate in RJ’s Barbershop, so instead of applying for a PPP loan, he collected newly available federal unemployment insurance benefits during the eight-week shutdown in the spring. After business restarted, Sharp estimated that operating costs shot up 20 percent as a result of the disinfectants he had to purchase and due to extended appointment times. He said that his expenses are now closer to between five and 10 percent above pre-pandemic levels.

Ultimate Sports and Graphics owner Rees also didn’t get a PPP loan; instead, he has pivoted to selling new categories of merchandise.

“A big thing right now is masks, so gaiter masks, or just your regular masks that have the straps that go around your ears. So now they are needing those in the schools, so we are offering custom masks here, so you can have an Honor G in red and black and white,” he said. Rees is also producing signs about mask wearing and social distancing.

The new products are a lifeline, but they haven’t replaced the business lost because of COVID-19, said Rees.

Now that College has announced that the second Fall term, F2, will continue to operate entirely online, many Grinnell businesses are likely to be facing that same reality for months to come.