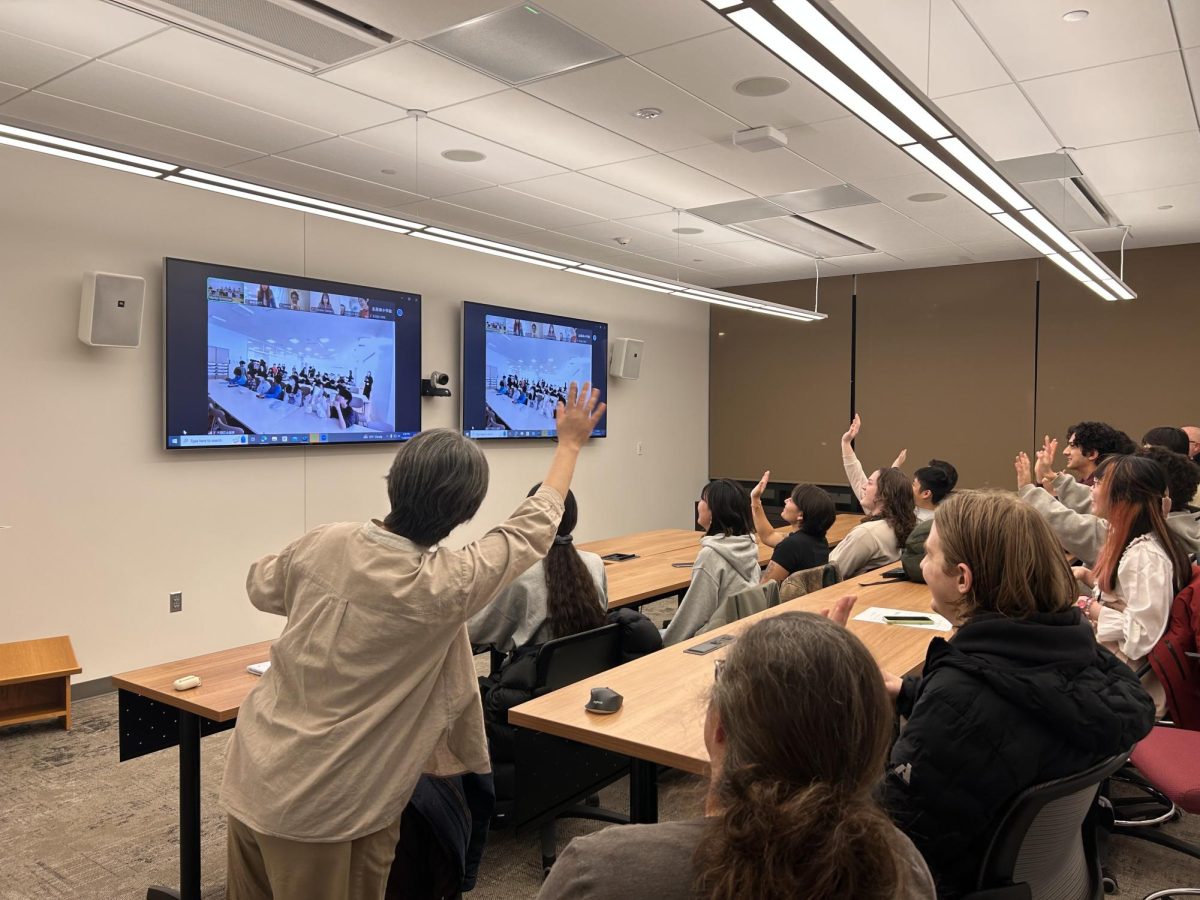

On Tuesday afternoon, the chairs of the Student Investment Committee, Anna Hall ’13 and Sarah Goff ’11, held a forum to discuss the social responsibility of the investment of the College’s investment. The forum touched on the unintended consequences of investing in socially responsible endeavors.

The panel members were Trustee Fred Little ’53, who sits on the Investment Committee, Professor of Economics Mark Montgomery, former President of the College and current Professor Emeritus of History George A. Drake ’56 and David Kurzman, Portfolio Manager at Leuthold Weeden Capital Management.

Professor Montgomery discussed making a difference to the world versus making a difference to individuals through investment and the impact of each. He told of the impact of his money on his personal investment in an orphanage in Sierra Leone and the adoption of his son, both of which benefit greatly from his investment.

“You can invest to help Africa or you can invest to help Africans. You won’t be making a big difference to Africa with your money, but you can make a big difference to Africans,” he said.

But Professor Montgomery also spoke about the unintended consequences in responsible investing. He gave an example of a brand that used child labor in sweatshops in Bangladesh, and when the US learned of the brand’s practices, they withdrew their investment.

“What we didn’t think about was that all those children are left with no jobs to support their families. So where are they going to turn?” he asked.

Kurzman’s PowerPoint presentation detailed options for investment in green technology and the risks of doing so. He advocates supporting companies that help reduce humans’ impact on the environment by investing in lasting green technologies. He noted that the power to create change comes through investment.

“We vote with our dollars,” he said.

Kurzman warned of investing in companies that paint themselves green when in actuality they are not very green. He used BP as an example of this effect as BP receives 95 percent of its profits from oil yet advertises its use of solar and wind energies. He also cautioned against investing in fad technologies, as they are risky.

During the Q&A after the panelists presented, students inquired into what socially responsible investment means for the College’s endowment. President Raynard Kington, who was in attendance, said that the College’s higher endowment allows for more flexibility in deciding where the money goes.

In response to a question about the students’ desire for the College to invest in a windmill, Kurzman suggested that the money might be better spent elsewhere such as financial aid and scholarships that would directly benefit Grinnell College students given the recent raise in tuition and the state of the economy.

“You can listen just as passionately as you can yell,” he said.