When we think about college, we usually imagine all-campus parties, overpriced textbooks and hours upon hours of studying. What don’t we think about? Investing. And honestly, that’s a missed opportunity. Whether you’re an econ major or someone who hasn’t touched a calculator since high school, investing early — even with a small amount — can set you up for financial freedom when you’re ready to retire.

Why should you even care about investing?

Let’s get this out of the way first — investing is not just for finance bros or people with a ton of money. It’s a tool that allows your money to grow over time instead of just sitting in a savings account. Your money isn’t really increasing when adjusted for inflation if it’s sitting in your bank account. Stocks have been a consistent long-term hedge against inflation for hundreds of years. Thanks to the power of compounding, even modest investments made in your early 20s can explode into something meaningful decades later.

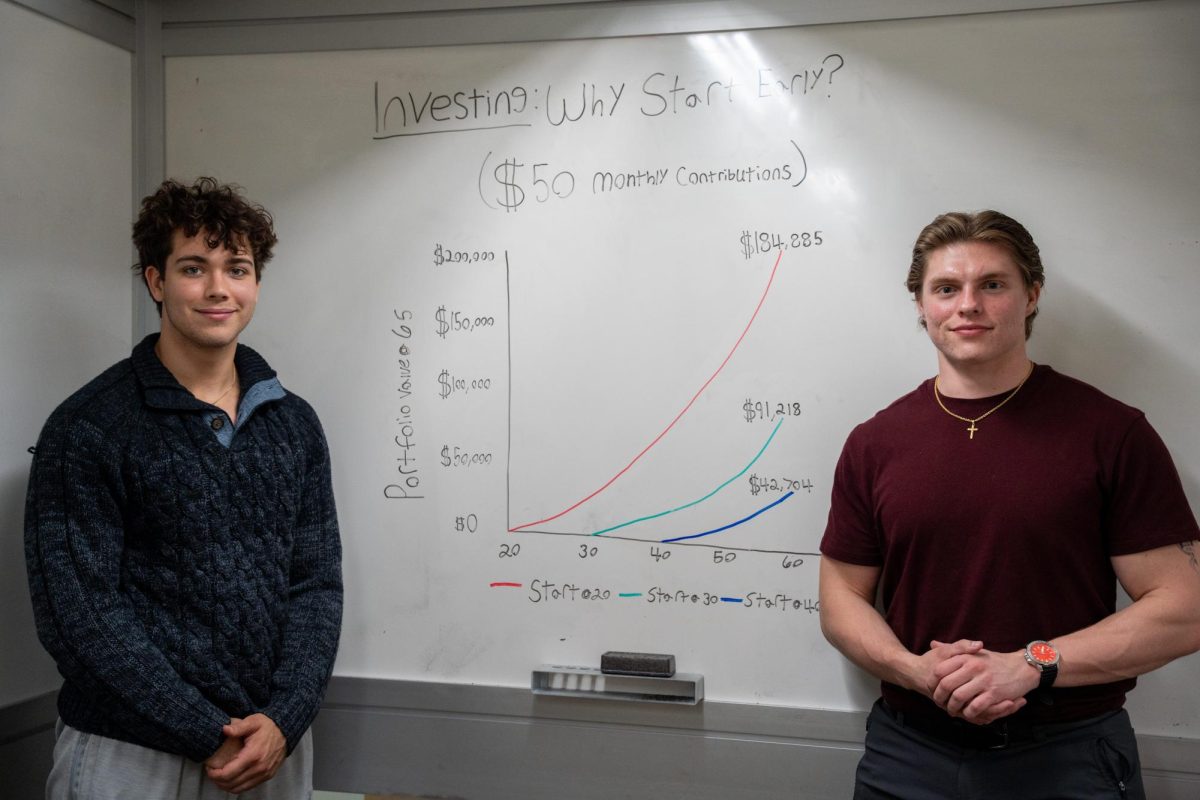

Here’s a quick example — if you invest $100/month starting at age 22, and it earns an average return of 7% annually, a fairly conservative rate of return, by age 60 you’d have over $226,000. If you start at 30 instead? That number drops to about $120,000.

Same monthly investment, half the growth. That’s the power of starting early. Even further, if you happened to invest $200/month at 22, you’d be 60 years old with $452,000. The more money you throw at a mutual fund or ETF, the more it compounds.

A lot of students hesitate to invest because of fear, a very real fear of losing money, of not understanding the finance talk, of making mistakes. But the truth is, you don’t need to be a Wall Street guru to get started. As Carlos Slim Helu, the wealthiest man in Mexico, once said, “Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.”

Yes, the market can be volatile. It will go up and down. But historically, the U.S. stock market has returned an average of 7 to 10% annually over the long term — even factoring in recessions.

In fact, if you took the worst financial crisis of all time, The Great Depression, and invested at the top of the market before the crash, at worst it would’ve taken seven years to break even with your money, and 21 years to see your investment increase eightfold. Nevertheless, it is important to invest across many different types of assets in times of great uncertainty.

So, how does one actually start investing? Here’s a step-by-step guide to help introduce you into investing without getting overwhelmed.

First, learn the basics — just a little! You don’t need to read “The Intelligent Investor” cover to cover, but understanding some key concepts — like stocks, bonds, mutual funds, exchange-traded funds (ETFs) and compound interest — will make you feel a lot more confident.

Secondly, choose a platform. Apps like Fidelity, Vanguard and Schwab, make it simple to start investing with as little as one dollar. These platforms also offer Roth IRAs, which are retirement accounts that grow tax-free, a great option for college students with part-time income. Additionally, if you don’t want to do the work, these broker dealers have people who would be more than happy to do the work of investing for you.

Third, start small. Even 10 dollars a month matters. Pick an actively managed or passive diversified fund, such as a mutual fund or an ETF, that piques your interest — for reference, a mutual fund is a pool of money from many investors that a professional manager uses to buy a mix of stocks, bonds or other investments for you, while an ETF is a bundle of investments like a mutual fund, but it is usually passively managed.

Before you buy a mutual fund or an ETF, you can read a short document called a summary prospectus. This explains what the fund is trying to do, like what kinds of things it invests in and what its goals are.

If you’re a risk-loving investor, you might look for mutual funds that invest in smaller companies, emerging markets like quantum computing or riskier bonds — it may say speculative-rated or junk bonds on a prospectus.

If you’re risk-neutral, you might look for mutual funds that are trying to beat the overall market, like funds that aim to outperform the S&P 500. You’re okay with some risk, as long as the potential reward is worth it.

And if you’re risk-averse, you’d want a mutual fund that invests in large, well-known companies or stable government bonds. Many ETFs are a good choice too, especially ones that just try to track an index like the S&P 500. These are generally lower risk and more predictable.

Typically, the older you get, the less risky you want to be. If you’re cautious and don’t want to do the work, look into target-date funds, which automatically adjust the risk level as you get older. As Vanguard founder John Bogle once said, “Don’t look for the needle in the haystack. Just buy the haystack!”

Lastly, stay the course — don’t panic when the market dips. That’s normal, and investing is a long game. Think in terms of years or even decades, not days or months. It is nearly impossible for even the best traders to predict the market over the short term. Once you’ve decided on a few mutual funds or ETFs, automate your contributions and let it ride. The key is consistency.

It’s also worth acknowledging that investing isn’t just about individual wealth — it’s also a tool to close generational wealth gaps. 18th century English cleric and founder of the Methodist church John Wesley said, “Earn as much as you can, save as much as you can, invest as much as you can, give as much as you can.” Many marginalized communities have been historically excluded from financial systems. As Grinnellians, we can use investing not just to help ourselves but to empower our communities by giving generously.

Yes, investing has risks. Stocks can go down, companies can fail, and recessions happen. But not investing also has risks — mainly, the risk that your savings won’t keep up with inflation. Leaving your money in a basic savings account might feel safe, but over time, its buying power shrinks.

College is expensive, and many of us are juggling jobs, classes and student loans. But that’s exactly why investing something now, no matter how small, is so important. You’re building a habit. You’re laying a foundation. And you’re taking control of your future, one dollar at a time.

Prominent businesswoman Mellody Hobson, who’s best known as co-CEO of Chicago-based Ariel Investments, one of the largest Black-owned money managers in the U.S., says it best: “The biggest risk of all is not taking one.” So, next time you find yourself spending $5 on an overpriced coffee from the Global Café, consider putting even a fraction of that cost toward a share of your future instead.

Invest sooner rather than later. Your future self will thank you.