By Peter Sullivan

sullivan3@grinnell.edu

Some professors are asking whether projections for endowment returns are too low in models used to show the need for financial aid changes, and interviews with professors indicate the faculty largely believes the College’s financial situation requires at most modest changes that retain the need-blind admissions policy they overwhelmingly support.

The Committee on Admissions and Financial Aid, which has student, faculty, staff and alumni representation, is nearing a recommendation for policy changes to raise more revenue from students to address what is projected to be an unsustainable financial trajectory for the College. Changes to need-blind admissions were put on the table at the beginning of the process, while changes to meeting students’ full demonstrated need were not.

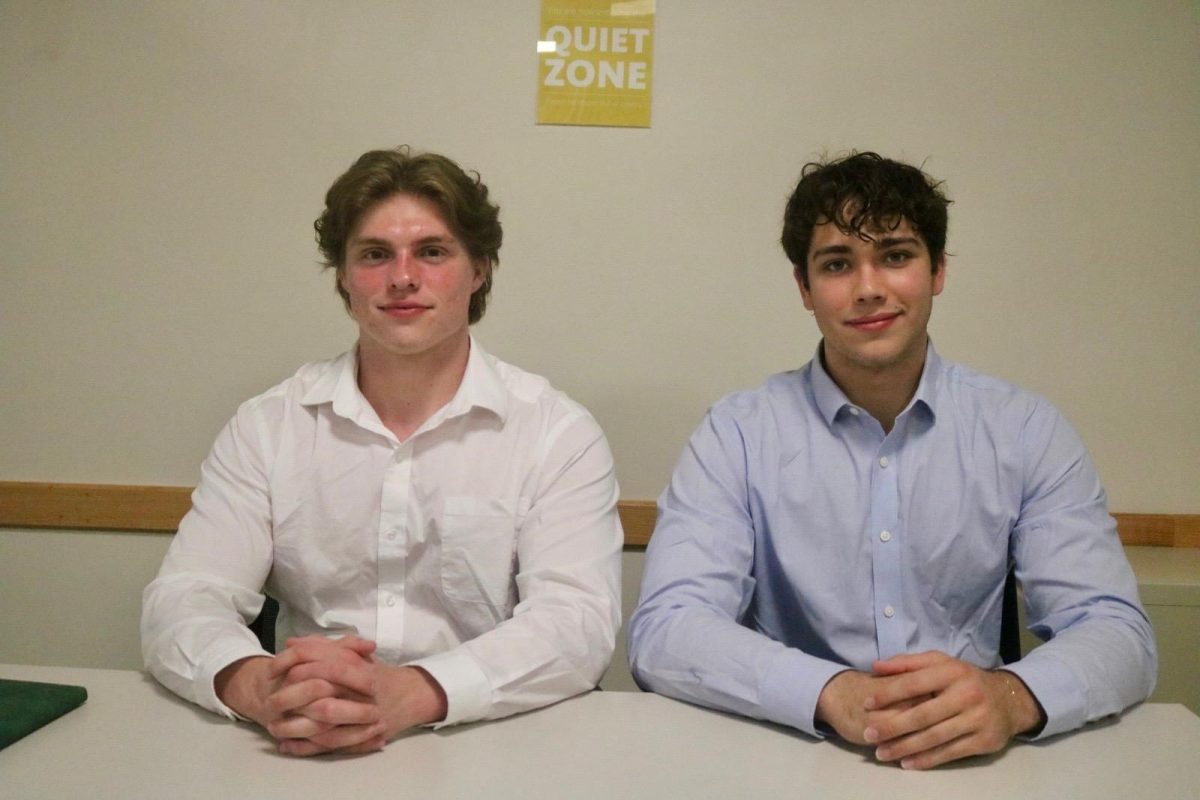

According to Kathy Kamp, Chair of the Faculty and a member of the committee, the committee is likely to recommend keeping need-blind admissions while taking other steps to moderately increase student revenues, such as a small increase in the cap on student loans.

“I would say pretty much, as universally as things ever get in the faculty, that people really support the idea of need-blind admissions,” Kamp said.

President Raynard Kington also indicated at a town hall meeting earlier this year that he expects the College will remain need-blind. However, the final decision is with the Board of Trustees, who plan to vote in February after hearing a recommendation from Kington.

As this decision-making process continues, some professors have expressed concern with the underlying models used to show the need for admissions and financial aid changes. Specifically, there are questions about whether the endowment returns projected in the models are too low. If returns from the endowment were projected to be higher, the projected upcoming financial shortfall would be less severe.

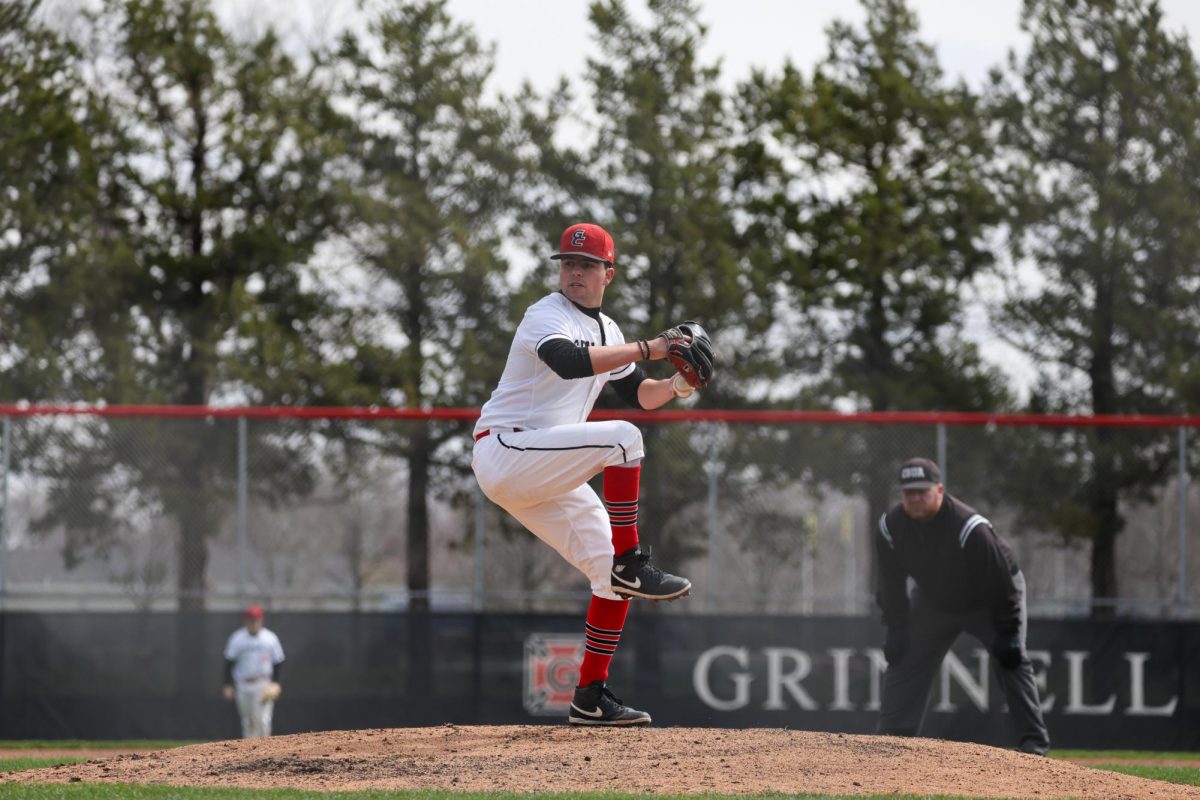

The average 10-year return for colleges and universities with endowments over $1 billion was 6.9 percent in 2011. Grinnell’s 10-year return over that period was seven percent, according to Vice President for Finance Karen Voss.

That 10-year period included the bursting of the dot-com bubble and the 2008 financial crisis, both of which led to returns that were lower than usual. In the models used to decide financial aid changes, the endowment is projected to have returns of four percent, a lower return than even the troubled past decade.

“That would be the part of the story that would question: if we could have an average return of 6.9 percent over a decade in which there were two major downturns, are we being overly conservative in what we’re trying to treat as a spending policy right now?” said Jack Mutti, Economics.

However, factoring in inflation and flat student revenues, projecting higher endowment returns might only put off the problem for a few years. Under a model used in the explanatory slideshow online, with a 4 percent endowment return and an increase in financial aid from a 2 percent increase in the tuition discount rate, the College will face a $2.5 million deficit in fiscal year 2016. Mutti said projecting a slightly higher endowment growth rate might delay a deficit until 2019 or 2020, for example.

“I think the Committee on Admissions and Financial Aid is looking at some possibilities that I would say don’t lead to major changes in what we’re doing now, that would maintain the need-blind commitment, that would maintain the full need commitment,” Mutti said. “So they would be more what I would call minor tweaks to the system. I think those are the things people are looking at, recognizing that we’re not in a crisis mode, we do have time to adjust, but what are the sorts of things we could do that would improve this story of saying if there’s no growth at all in student revenues, that puts increasingly high stress on how fast the endowment has to go up?”

Voss, the Vice President for Finance, said her intent has been to show the tradeoffs involved in pulling different budget levers, including the endowment. “I do not believe the projections I used in the lever concept are affecting predictions for what admission changes are needed,” she said in an email. “Even with higher net endowment returns, the fact that fundraising is not growing in the short term and net student revenues are relatively flat from year to year, it is still not sustainable for the endowment to pay for more than 50% of everything we do in the longer term.”

She added that Dave Clay, the College’s Chief Investment Officer, advises that since economic growth forecasts are low, it is likely that investment returns will also be low.

Pablo Silva, History, who worked on a committee last year as part of strategic planning that recommended maintaining need-blind admissions, said the endowment projections are one factor in his desire for only small changes, such as perhaps raising the loan cap.

“I don’t think a lot of things that are proposed are so crazy that it’s not worth trying,” Silva said. “I do worry about taking any steps that would sort of affect the identity of the school, sort of basic, core principles of the school, that have been in place since long before I arrived, and just walking away from them, based on projections that I am still not clear on.”

Kamp said she knew when she found out need-blind admissions might be changed that a contentious process was coming. “As soon as I heard about it, which was last summer, my first reaction was, ‘Wow, faculty and others have to start talking about this right away,’” Kamp said. “It can’t just come from on high or all hell will break loose.”

But since then, she said she has found the process healthy and open. “[The discussion of the possibility that need-blind might be abandoned] causes a lot of political fervor as faculty, students, alums, everybody gets upset,” she said. “I do want to say, however, that the administration has been really good about sharing information, which is unusual among administrations broadly, and this is incredibly important, if shared governance is to work.”

The faculty is expected to have a preliminary discussion of the Committee on Admissions and Financial Aid’s recommendation at its Nov. 19 meeting. In early December, the faculty will make a recommendation to Kington, who will then make a recommendation to the Board of Trustees in mid-December, before the board vote in February. Anyone can comment by emailing grinnellsfuture@grinnell.edu.

Sarah Purcell ’92, History, who is representing alumni on the committee, brings firm beliefs to the process. “I think it’s extremely important for us to maintain need-blind and meeting the full demonstrated need, and I think that is a core value of Grinnell College,” Purcell said. “And I think it’s really important to Grinnell College, and so I think that we need to find a way to do that and be economically sustainable. I think that luckily we are a very wealthy college and we can make a plan.”

Jake White • Nov 12, 2012 at 10:26 am

Is there no leftist presence in the faculty? Need- blind aid is thoroughly centrist, it assumes meritocracies can avoid economic inequality. Given the state of the US education system this is arguable. The alternative, justifying cutting support for the poor on account of projections of financial instability when you have a $1 billion endowment that didn’t shrink during a recession, makes me sort of sick.

Either way, it appears the political outlook of the faculty and administration reflects the larger political scene today. Our choices are conservatism and the hard right.

I agree with Professor Mutti, we should spend. And our spending should be to give opportunities to

students who need a Grinnell education most.