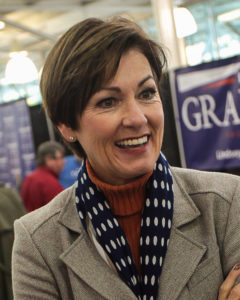

The final days of 2017 saw Washington in a furor of activity, as President Donald Trump and Republicans in Congress passed a sweeping federal tax overhaul, temporarily lowering rates for all manner of individuals and entities. Despite controversy surrounding the bill’s passage, according to Governor Kim Reynolds, it is now Iowa’s turn to follow suit.

In a Feb. 13 press release, Reynolds made the case that tax reform in Iowa is imperative now more than ever because of a provision in the Iowa tax code that allows Iowans to deduct their federal taxes from their state taxes. While Republicans at the federal level intended their legislation to lower taxes, this peculiarity of the Iowa code may lead to an actual tax rise for many Iowans, according to Reynolds.

Tax reform has been a goal for the Governor since she replaced Terry Branstad, now U. S. Ambassador to China, on May 24.

“Our tax rates are some of the highest in the nation, and our code books are filled with a patchwork of exemptions, deductions and credits. … Our tax code should be simple. It should be fair. And it should inspire — not inhibit — growth,” Reynolds said in her inaugural speech.

The Governor’s office recently released more details on Reynolds’ vision for tax reform, which her office has dubbed the “Reynolds Reform Plan.” The office’s press release calls the plan “the most significant tax reform package in decades,” and claims that it will provide “immediate relief to middle class workers, small business owners, farmers, families and teachers across Iowa.”

In her first Condition of the State Address, Governor Reynolds specified that to fully revamp taxes in Iowa would take a “multi-year effort,” especially due to Iowa’s current budget woes. She expressed a desire to lower uncompetitive corporate taxes but acknowledged that, due to budget considerations, “this is not the year.” If Governor Reynolds, who is up for reelection in 2018, maintains her position as Governor, she will likely push for a more complete reform package in the years to come.

For now, Reynolds’ plan will cut tax rates by up to 23 percent, resulting in $1.7 billion in tax savings through 2023, according to her office. Of those cuts, the middle class will receive a significant portion. Small business will be able to deduct more from the federal Qualified Business Income Deduction and online sales will face increased taxation, a boon to businesses in Iowa that struggle to compete with Internet behemoths like Amazon. The press release also stipulates that “state budget priorities [will be] protected” and that this reform will, in the end, simplify the Iowa tax code.

These are only the preliminary details of Governor Reynolds’ plan, and the full bill will change as it is introduced and debated in the Iowa House and Senate. Democrats, who are in the minority, say they are willing to work with Governor Reynolds and Republicans, but they are wary of the impact such tax cuts would have on the state budget.

While no official plan has been submitted by Democrats, Senator Pam Jochum of Dubuque, the ranking Democrat on the Senate Ways and Means Committee, sent a letter to Governor Reynolds in June 2017, outlining her own requirements for tax reform.

“We must avoid changes that would make our tax system less transparent, make low-income and middle-class Iowans pay more taxes, and prevent us from addressing the budget priorities of our constituents,” Jochum wrote in the letter. She also requested that legislators look into the corporate tax in Iowa.

In an email to The S&B, Grinnell’s Representative Dave Maxwell said that he would be unable to make any commitments until a full tax plan was released in the House and Senate, but that he would be open to working with Republicans and Democrats alike to create an acceptable plan.

The potential impacts of the tax plan on Grinnell College are likewise difficult to gauge, given the current sparseness of detail on the plan.

Whatever the result of Governor Reynolds’ reform effort, Republicans in Iowa have placed the issue front and center in this year’s legislative session, and it is sure to shape Statehouse races, not to mention Governor Reynolds’ own reelection campaign, in 2018, and may very well might affect Iowan’s taxes for years to come.

Jean Donaldson • Feb 24, 2018 at 10:19 am

Thanks, Seth. Nice and clear handling of what could be a drab topic.